Small businesses need a strategic approach to investment in order to achieve sustainable growth. Above all, it's crucial to conduct a thorough assessment of your existing financial position and identify areas where investment can be most impactfully allocated. This may include deploying profits back into the business, applying for external funding sources like loans or grants, or exploring equity partnerships.

A well-crafted investment strategy should match with your long-term business goals and take into account sector trends. Prioritize investments that have a significant return on assets (ROI) and contribute to enhancing your core capabilities.

It's also important to maintain financial discipline by tracking expenses, observing cash flow, and adopting sound financial mechanisms.

By embracing a proactive and well-planned approach to investment, small businesses can nurture a foundation for sustainable growth and achieve their full capacity.

Marketing on a Budget: ROI-Driven Tactics for Small Businesses

Small companies often face the challenge of promoting their products or services without devoting a fortune. However, there are plenty of budget-friendly marketing tactics that can deliver a strong return on capital.

One key approach is to focus on natural marketing channels such as social media, content marketing, and email advertising. By creating valuable materials that your target audience will find interesting, you can attract their attention and build a loyal following.

Another impactful tactic is to leverage the power of customer feedback. Encourage satisfied customers to share their opinions online, as these can foster trust and credibility with potential buyers.

Finally, remember that measuring your results is crucial for pinpointing what's working and what needs improvement. Use analytics tools to track key metrics such as website Investment traffic, social media engagement, and conversion rates. By refining your strategies based on the data you collect, you can maximize your profitability and achieve your marketing objectives.

Unlocking Investor Interest: Crafting a Compelling Business Plan

Securing capital is essential for any burgeoning business. Investors seek ventures with tangible potential and articulate roadmaps to success. This is where a meticulously crafted business plan emerges. A compelling business plan acts as a framework, outlining your company's vision, approach, and projected performance. It grabs the attention of potential investors by showcasing the value proposition of your venture and demonstrating its ability to thrive in the marketplace.

A well-structured business plan should clearly articulate the following key elements:

* Introduction

* Market Analysis

* Products and Services

* Marketing and Sales Strategy

* Financial Projections

* Leadership Profile

Decoding Angel Investing Success: Pinpointing Lucrative Startups

Successful angel investing hinges on acumen discernment. It's about identifying startups that possess not just a compelling idea, but also the ingredients for sustainable success. While market trends and technological advancements play a role, true investor insight often stems from understanding the founders behind the venture. A seasoned angel investor scrutinizes not only their experience but also their passion to bringing the service to market.

- Furthermore, a thorough investigation is paramount. This involves exploring the market potential, analyzing the plan, and assessing the environment.

- Ultimately, angel investing is a blend of art and science. It demands a blend of analytical thinking, market savvy, and a willingness to take on the future.

Navigating Venture Capital: A Guide for Aspiring Entrepreneurs

Securing funding via venture capitalists is a crucial step for aspiring entrepreneurs. These funding institutions supply not just capital, but also expertise and relationships that can be pivotal to your success. However, navigating the venture funding landscape can seem daunting.

Here are some essential factors to keep in mind as you venture this journey:

* First crafting a compelling startup plan that clearly outlines your mission, target market, and financial projections.

* Develop a strong circle of mentors, advisors, and fellow entrepreneurs who can offer valuable insights.

* Be persistent and resilient throughout the quest.

in that securing venture capital is a marathon, not a sprint, and achievement often requires patience.

Funding Your Journey : Funding Your Small Business Venture

Securing the resources you need is a crucial milestone in your small business journey.

As you expand, understanding the various financing choices available is essential for success. From established loans to alternative funding methods, there's a path suited to your business's goals.

This resource explores the diverse world of small business finance, helping you discover the best approaches to fuel your growth. Whether you're just beginning or looking to scale your existing company, we'll provide valuable knowledge to empower your journey.

Explore the essentials of small business capital and unlock the potential for sustainable growth.

Mara Wilson Then & Now!

Mara Wilson Then & Now! Judge Reinhold Then & Now!

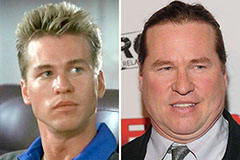

Judge Reinhold Then & Now! Val Kilmer Then & Now!

Val Kilmer Then & Now! Monica Lewinsky Then & Now!

Monica Lewinsky Then & Now! The Olsen Twins Then & Now!

The Olsen Twins Then & Now!